Treasury suffers setback as MPs reject proposal to scrap 15% tax incentive for car assemblers, housing developers

The MPs made it clear that they expect the incentive to be given sufficient time to bear fruit, particularly once economic conditions stabilise.

The National Treasury suffered another blow after the National Assembly rejected its move to eliminate the 15 per cent corporate income tax rate for local vehicle assemblers and large-scale housing developers.

MPs from the Departmental Committee on Finance and National Planning on Tuesday insisted that the incentive, introduced in 2023, should be allowed to run its full five-year course despite recent declines in sector performance.

More To Read

- Treasury’s plan to abolish six development authorities raises fears over 423 projects, 1,500 jobs

- Judiciary faces Sh576.6 million pending bills amid budget review

- MPs fault State officers over mismanaged road projects

- MPs warn Sh2.4 billion tax dispute between KRA and NG-CDF could paralyse constituencies

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

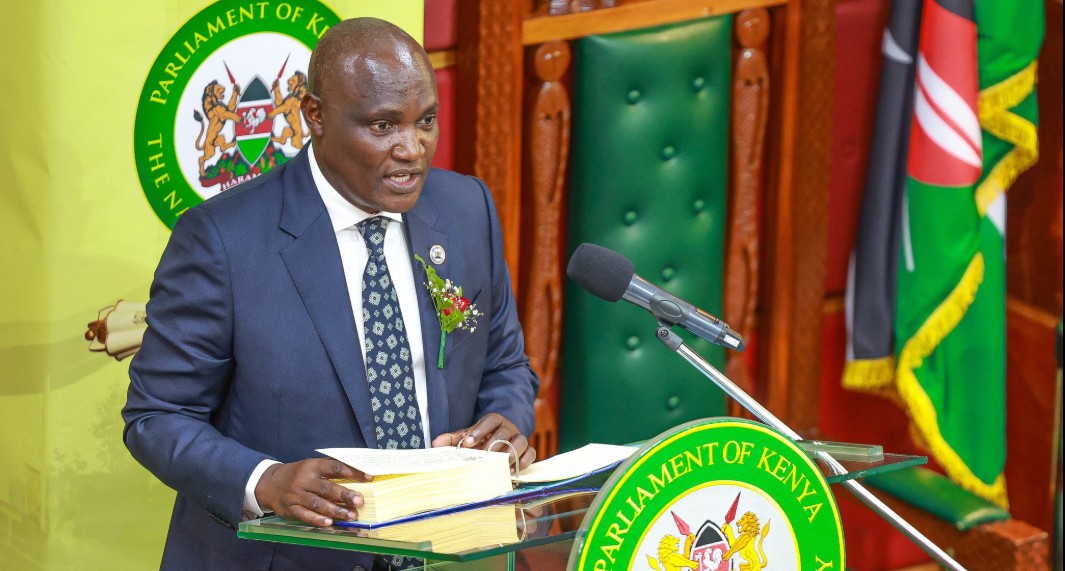

The Committee, chaired by Molo MP Kuria Kimani, dismissed Treasury’s argument that the policy had failed, warning that ending it prematurely would damage investor confidence and derail national objectives on manufacturing and affordable housing.

Treasury Cabinet Secretary John Mbadi had proposed reverting beneficiaries of the tax incentive to the standard 30 per cent corporate tax rate, arguing that the reduced rate introduced in 2023 had not delivered the anticipated growth.

Citing statistics, Mbadi noted that local motor vehicle assembly volumes had dropped by 14.58 per cent in 2024, with only 11,555 units assembled, down from 13,527 in 2023.

He also highlighted a 10 per cent fall in cement consumption, a key indicator of real estate activity during the third quarter of 2024, compared to the same quarter in 2023, as further evidence that the incentive was not working.

However, the parliamentary committee said these figures failed to reflect the broader context of a strained economic and political environment.

They pointed to high financing costs, with commercial interest rates rising above 20 per cent in 2024, and political disruptions, including the Gen Z protests in June, as significant factors affecting investor performance during the period under review.

“Removing the incentive risked disrupting ongoing investments, diminishing investor confidence, and undermining national efforts to promote local manufacturing and reduce the housing deficit,” the committee said in its report.

The legislators insisted that a two-year period was not sufficient to evaluate the impact of the tax incentive on sectors that depend on long-term planning and heavy capital investment.

They argued that the ongoing investments needed a stable and predictable policy environment to succeed and warned that Treasury’s attempt to withdraw the incentive prematurely undermined the principle of a consistent tax regime.

“Retaining the 15 per cent corporate tax rate was viewed as necessary to uphold policy stability, encourage long-term investment, and maintain momentum in these vital areas of the economy,” the committee added.

The decision to reject Treasury’s proposal means the 15 per cent tax rate will remain in place for the remaining three years of its intended duration.

The MPs made it clear that they expect the incentive to be given sufficient time to bear fruit, particularly once economic conditions stabilise.

Their decision also reaffirms Parliament’s support for strategic incentives aimed at driving local manufacturing and addressing the housing deficit.

Top Stories Today